Fannie Mae New Regulation

Why this new regulation is good for us?

- Market Corrections Underway

- DSCR Rule

No need to worry about personal income or credit score. DSCR covers the credit. Finding a good deal is the key. Not your income or credit score.

DSCR stands for Debt Service Coverage Ratio DSCR 1.55 and 1.45, you will get a loan. DSCR 1.33 and 1.25, lender will consider. DSCR below 1.25, you will not get a loan.

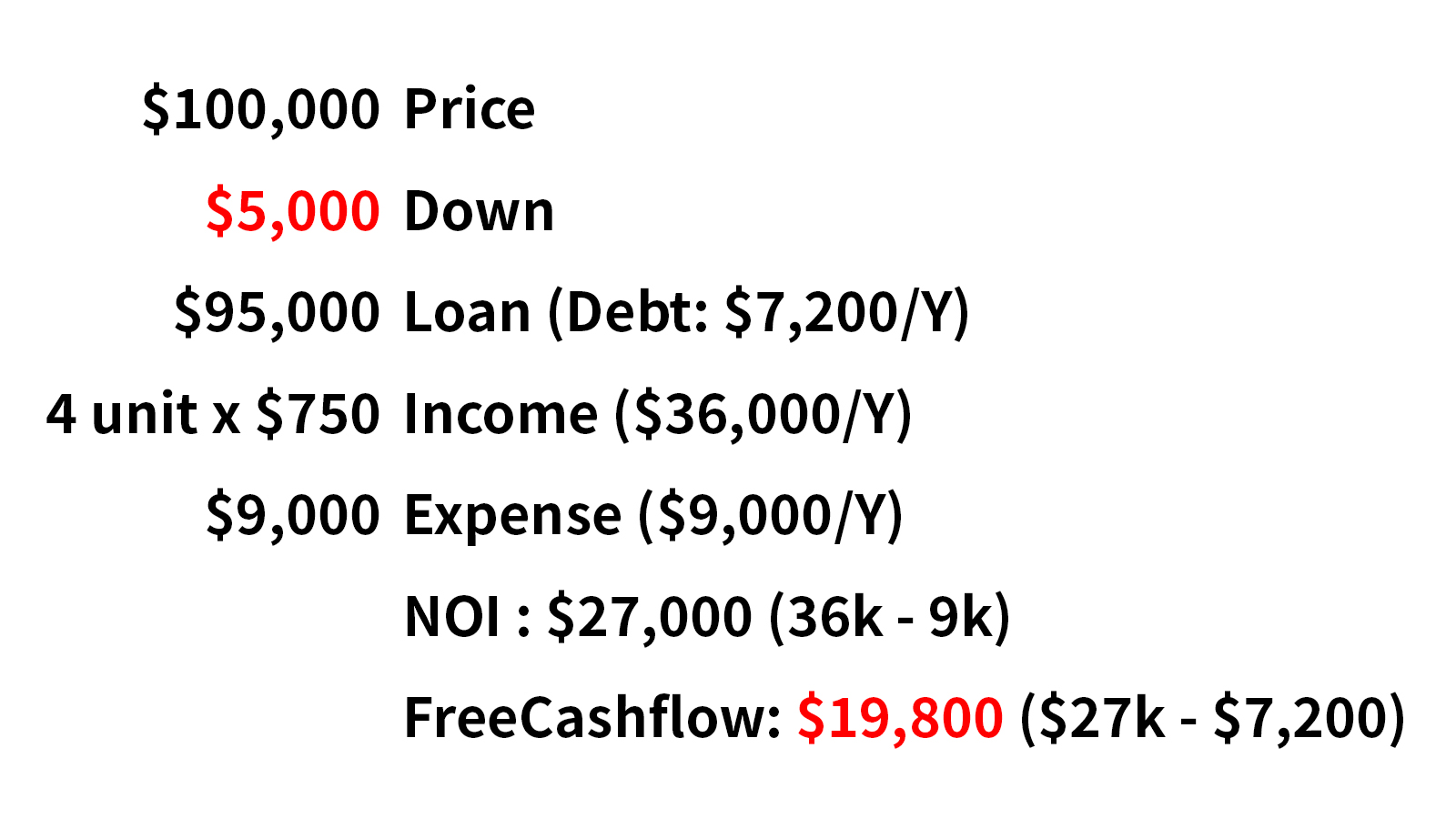

So, DSCR means will NOI cover Principal and Interest of a Real Estate Deal. (NOI = Gross income - Expenses) | DSCR Calculator Click Here

SFH(Single Family Home) is usually down 25% with a good credit score

MF(MultiFamily), Now, Up to 4 Units with 5% down

Fannie Mae's new regulation Max Loan is currently $1.39M

FannieMae got rid of the rule FHA75 which required 75% covered by income, but now they get rid of the rule.

There is a real estate correction coming in 2024 on the way. Real Estate experts are saying that we have about an 18-month window. Why the correction is coming? Debt market. $1.7T of debt on the multifamily market.

Where to find up to 4plex deals?

Multifamily Underwriting Example

Number of Units: 12

Rent: $900

Other Income: $0

Occupancy: 93%

Expenses: 40%

Cap Rate: 6%

=

Actual Income: 48,211

Price to Offer for the deal: 1,205,280

NOI Example for 4 Plex

Will be super city: Miami, Houston TX, Nashville TN, Dallas TX

Under the new Fanniemae regulation, you have to live there for 1 year and occupy the rest with tenants. The default rate in the 4 plex asset class is less than 1%. The single-family home default rate is 6%.

New Fannie Mae Regulation Summary

- 2,3,4 Unites Qualify for 5% down payment

- Owner occupied within 60 days for 12 months (I will pay my rent. Pay as your tenants pay. So when you leave you will continue getting paid.)

- Max Loan is $1.39M (Do a self-finance deal if the property is higher than 1.4M) | 1.4M 5% Downpayment: $70,000

- FHA Rule 75 (75% of rental income must exceed the mortgage) was eliminated.

Fannie Mae New Regulation Resources